Milestone Credit Card Review: Everything You Need to Know

Contents

A credit card is a convenient payment tool that keeps your funds both secure and accessible. According to Statista, credit cards were among the two most popular payment methods in the United States in 2024.

But what do you do if your payment history is less than stellar and the bank’s trust in you as a responsible payer is undermined? The solution is here — Milestone Mastercard. This practical option is designed to help you rebuild credit and move forward with confidence.

What is a Milestone credit card? How does it work, and is it the right fit for you? We discuss these questions and even more in our detailed Milestone Mastercard reviews.

Milestone Card: Features and Benefits

Is a poor credit history holding you back? Having a credit builder's loan is an excellent idea to improve your financial standing. Fortunately, you can apply for the Milestone Mastercard even with a limited credit score. This card offers 24/7 access to your account and a range of other benefits, including:

- No deposit required;

- Pre-qualification available;

- Free access to a credit score;

- Customizable card design.

Let’s explore each benefit in more detail.

No Deposit Required

While some banks require a security deposit starting at $500, Milestone cards do not. This makes them accessible even for those with limited credit availability or a poor credit history. Additionally, using the card responsibly can help improve your credit score and provide access to a relatively high credit limit.

Pre-Qualification Available

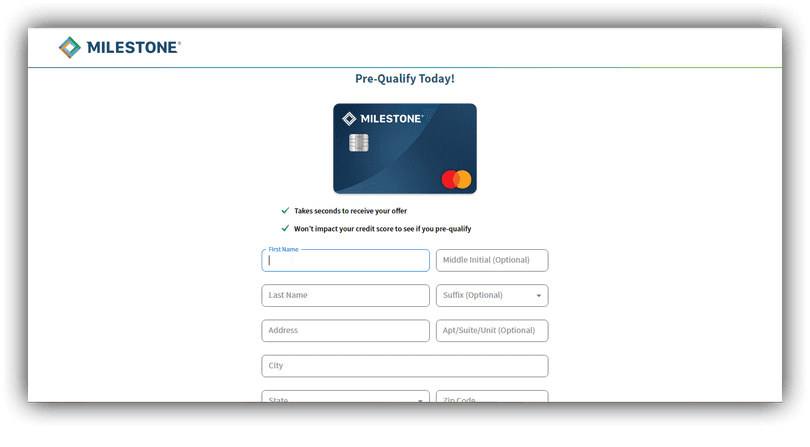

Pre-qualification is a process that allows you to find out if you meet the requirements for obtaining a credit card.

Save time and effort by completing this process online with Milestone! Provide specific personal information (name, address, email, phone number, insurance, Social Security number, date of birth), and within a few seconds, you’ll know if you’re eligible for an offer.

Free Access to a Credit Score

Your credit score is a key indicator of your financial health, which quantitatively reflects your creditworthiness. With Milestone Mastercard, you can track your progress for free and monitor your credit history transparently. Moreover, you can identify specific issues with your credit history and take action to improve it.

Customizable Card Design

Personalize your card to match your style! Choose from different card colors, fonts, or images, making it unique and more attractive. Not sure which design to pick? Use the card customization tool to experiment with different options or opt for a universal design.

Milestone Mastercard: Rates and Fees

Milestone card reviews from Rates experts have shown that this credit card is an effective way to improve even significantly poor credit history and credit score. However, it comes with higher fees and interest rates.

Annual and Monthly Fees

An annual fee is required to use the credit card. Milestone’s annual fee is $175 for the first year of use, and from the second year onward, it drops to $49. Additionally, there is a monthly fee of $12.50, which makes this card one of the most expensive credit cards for personal use.

APR (Annual Percentage Rate)

The APR varies depending on the balance and credit history. The standard Milestone credit card interest rate ranges from 24.9% to 29.9%. However, if you have a poor credit score, you may be offered a card with an even higher annual percentage rate (starting from 35%) to compensate for potential risk.

Penalty Fees

Credit companies impose penalty fees on customers for violating the contract terms. The Milestone Mastercard charges a fee for late payments, exceeding the limit, and returned payments. In all cases, the amount is up to $40. To avoid penalties, ensure you pay your full balance on time, stay within your credit limit, and adhere to the terms of use.

Foreign Transaction Fees

If you withdraw cash abroad or make international purchases, you will be charged a fee for withdrawal and a currency exchange fee. If you make an online purchase with the Milestone Mastercard, be prepared for transaction fees:

- For foreign transactions: 1% per transaction;

- For cash advances: Free for the first year, then $5 or 5% per transaction (whatever is greater).

Check this table to compare fees across different Mastercard options.

Annual Fee | APR | Penalty Fees | Foreign Transaction Fee | |

|---|---|---|---|---|

Milestone Mastercard  | $175 (for the first year), then $49 | 35,9% | Up to $40 | 1% per each transaction |

Fortiva Mastercard  | $49 to $175 (for the first year); | 22.74% to 36% | Up to $41 | 3% per each transaction |

Latitude Platinum Mastercard  | $0 (Elite Card), | 24.49% to 28.24% | Up to $41 (for late payments) Up to $30 (for returned payments) | 3% per each transaction |

First Digital Mastercard  | $75 (for the first year), then $48 | 35.99% | Up to $41 | N/A |

Reflex Platinum Mastercard  | From $75 to $125 | 35.90% | Up to $41 | 3% per each transaction |

Milestone Customer Support System

Credit cards are complex financial products that require careful management like any other money-related matter. Whether you need to increase your credit limit, check the interest rates, or block your card, the Milestone Mastercard customer service is ready to help and will provide clear answers to your questions.

Online Account Management

Gain access to your account information and manage it online through the Milestone website. There, you can check your balance and payments, view your transaction history, manage your account settings, and much more.

Mobile Application

If you’ve ever wondered, “Does Milestone Mastercard have an app?” The answer is yes! You can easily manage your finances on your smartphone with the special app for Android and iPhone users. Download it now to control your accounts, plan and monitor payment history, track balances, and receive alerts about potential fraudulent activities.

Phone & Email Support

Milestone experts are ready to help resolve any issues you may experience with their product. You can contact the helpdesk at the number 1-800-305-0330 or use this Milestone credit card address: Concora Credit | PO Box 4477 Beaverton, OR | 97076-4477.

FAQs (Frequently Asked Questions) & Resources

Milestone provides a database with FAQ section and other resources to help you find answers. Milestone Mastercard guides and reviews are also helpful ways to learn more about user experiences with Milestone and improve your financial literacy.

Final Thoughts

Is Milestone the right solution for you? In a word, it’s a particularly good choice for individuals with poor or average credit history looking to improve their credit score. Milestone customers can enjoy zero liability for unauthorized charges and track their balance and credit score anytime. A thorough review of the Milestone Mastercard and its alternatives shows its benefits outweigh its fees. However, remember to use it responsibly — don't spend more than you can afford, and to maximize its benefits, make payments on time.

FAQ

What is the credit limit of Milestone Credit Cards?

The limit of the Milestone credit cards is $700 without a need for a deposit. This is twice as much as typically offered to individuals with a below-average credit score, which makes this card a desirable option.

How can I apply for a Milestone Mastercard?

Visit the Milestone website and fill out the online Milestone credit card app. Provide the required personal details, review the terms, and submit your application.